Weighted Average Cost of Capital or WACC is a measure of the company’s cost of capital across all sources like equity, debt and preference shares. It’s the number which is used as the discount rate in a dcf model.

It represents the minimum return that a company must earn to satisfy it’s owners, lenders and creditors. It’s purpose is to determine the cost of capital based on the proportions of debt and equity in the total capital, hence the word weighted is used.

It has two components, cost of debt and cost of equity. It’s a common misconception that there’s no cost of equity. But the expected return by the shareholders is considered the cost of equity from a company’s perspective because if shareholders don’t earn that amount, they can just sell the shares. Cost of debt is basically the interest that is payable on borrowings.

To calculate the cost of equity, we’ll use the capital asset pricing model or CAPM.

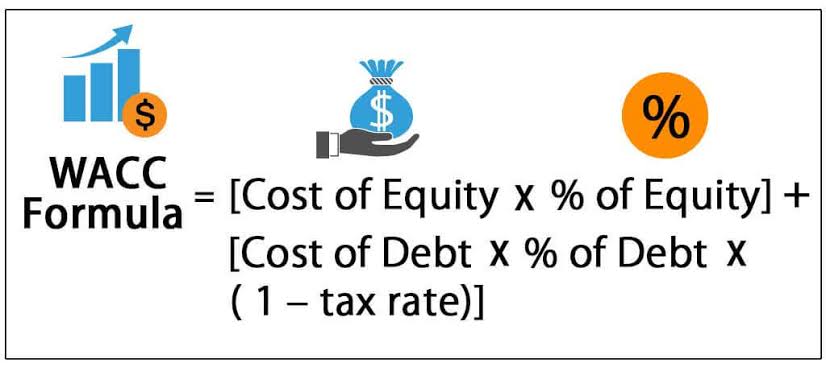

Formula for WACC:

Calculating cost of equity :

Cost of equity = Rf + B*(Rm-Rf) Here, Rf is the risk free rate. Which is the return that can be earned in riskless securities like govt. bonds. B is the stock’s beta, also knows and stock volatility. Rm is the annual return of the whole market.

For india, Risk free rate can be used as 6 percent. (Rm-Rf) is known as equity risk premium, which is a very long topic in itself which I won’t be able to articulate properly. But you can use a figure of 7.5 percent as Rm-Rf for Indian markets.

Calculating cost of debt :

1) calculate cost of debt by taking a company’s interest expense for the year, and dividing it by the company’s total debt(both short term and long term). Multiply it by 100 to get the percentage.

2) Then calculate effective tax rate by taking the company’s income tax expense and dividing it by income before tax. Multiply it by 100 to get the percentage.

3) As interest is tax deductible, to reflect that. The cost of debt calculated in the first step is multiplied by (1-t). Where t is the tax rate calculated in step 2. This is the final cost of debt.

WACC of Wipro

Cost of debt

- Interest expense = 4861000

- Short term debt = 73202000

- Long term debt = 4840000

- Cost of debt = 4861000/(73202000+4840000) = 6.23%

- Income tax expense = 24938000

- Income before tax = 122743000

- Effective tax rate = 24938000/122743000 = 20.32%

- Cost of debt(1-t) = 4.96%

Cost of equity

- Risk free rate = 6%

- Beta = 0.55

- Cost of equity = 6% + 0.55*7.5% = 10.13%

Final WACC Calculation

- Total debt = 78042000

- Market cap = 1974000000

- Total = 78042000 + 1974000000 = 2052042000

- Weight of debt = 78042000/2052042000 = 3.80%

- Weight of equity = 1974000000/2052042000 = 96.20%

- WACC = weight of debt*cost of debt(1-t) + weight of equity*cost of equity

- = 3.80%*4.96% + 96.20%*10.13%

- = 9.93%

In the above example, all numbers are in thousands.